Content

Ie credit one account, and debit another with the same amount. Every transaction a company makes, whether it’s selling coffee, taking out a loan or purchasing an asset, has a debit and a credit. This ensures a complete record of financial events is tracked and can be accurately represented by financial reports. This will go on the debit side of the Supplies T-account. You notice there are already figures in Accounts Payable, and the new record is placed directly underneath the January 5 record.

- He received his masters in journalism from the London College of Communication.

- The difference of these accounts is then carried to the unadjusted trial balance in the next step.

- A second use is to clarify more difficult accounting transactions, for the same reason.

- In the journal entry, Utility Expense has a debit balance of $300.

- Throughout the year as a company makes sales, transactions are entered into its accounting system in the form of journal entries.

- Increase in a loss account will be recorded via a debit entry.

That makes T accounts a good place to start when thinking about bookkeeping and accounting, but also financial management. T-accounts are typically used by bookkeepers and accountants when trying to determine the proper journal entries to make. Here are some times when using T-accounts can be helpful.

AccountingTools

When banks hold more than the reserve requirement, the extra reserves are called excess reserves. Banks’ bread-and-butter asset is, of course, their loans. They derive most of their income from loans, so they must be very careful who they lend to and on what terms. Some loans are uncollateralized, but many are backed by real estate , accounts receivable , or securities . A Credit side entry comes on the right side of a T account. It increases liability, expenses, and owner’s equity accounts and decreases asset and prepaid expense accounts.

The Unearned Revenue account would be used to recognize this liability. This is a liability the company did not have before, thus increasing this account.

Accounting Principles I

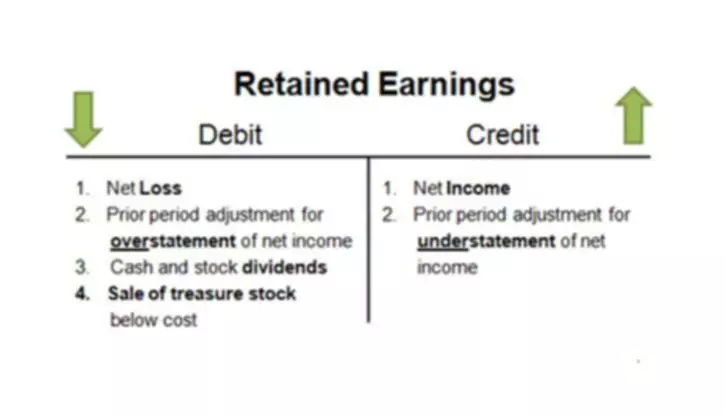

For different account types, a debit and a credit may increase or decrease the account value. The credits and debits are recorded in ageneral ledger, where all account balances must match. The visual appearance of the ledger journal of individual accounts resembles a T-shape, hence why a ledger account is also called a T-account.

When you’re ready to use T-accounts, you can use them separately, in order to view journal entry details, or you can enter the transaction directly into your journal. For instance, prior to processing closing entries, you can create a revenue T-account in order to check for accuracy. T-accounts also provide a tool for helping to ensure that your entries will balance. T-accounts are called such because they are shaped like a T. The business borrows £5,000 on loan from a bank on 4 July 20X2. This T appearance has led to the convention of ledger accounts being referred to as T-accounts. T-accounts show the effect of journal entries on the accounts that are involved in the transaction.

How do you make a T account?

The customer does not pay immediately for the services but is expected to pay at a future date. This creates an Accounts Receivable for Printing Plus. The customer owes the money, which increases Accounts Receivable. Accounts Receivable is an asset, and https://www.bookstime.com/ assets increase on the debit side. Printing Plus provided the services, which means the company can recognize revenue as earned in the Service Revenue account. Service Revenue increases equity; therefore, Service Revenue increases on the credit side.

In a single entry system, each transaction is recorded as a debit or credit to one account. There is no way to track the change in balance over time for a particular account. As you can observe from the above example, all the debit and credits entries have been posted to the appropriate side of the respective t-accounts. The balances are totalled in the end, in this example. This will give the management a holistic view of what is happening in his accounts and if there is anything out of the ordinary occurring. The opposite of what increases the account balances will hold to decrease those accounts.

What are T Accounts?

It can be used to balance books by adding all transactions in a set of accounts so the total debits equal the total credits for each account. This can cause a company’s general ledger to not balance.

- We will credit the bank account by $4,000 to reduce its balance.

- To teach accounting since a T account clearly explains the flow of transactions through accounts.

- You made a purchase of gas on account earlier in the month, and at that time you increased accounts payable to show you had a liability to pay this amount sometime in the future.

- Like a journal entry, T-account entries always impact two accounts.

- I use Google Sheets for my balance sheets because it allows me to easily color code based on Borja Clavero’s payment type classification.

A business owner can also use T-accounts to extract information, such as the nature of a transaction that occurred on a particular day or the balance and movements of each account. Gain some practice using T-accounts by completing the exercises, keeping in mind that each side of a T-account should balance as in the examples above. The business earned $10,500 for services rendered to its customers.

Accounts that track expense accounts, revenue accounts, gains, and losses use the debit/credit method in the same way as accounts receivable. A debit transaction increases the revenue accounts and a credit entry decreases it. Conversely, a debit will decrease the amount for expense accounts, whereas a credit will t accounts increase it. Entering a debit transaction to cash accounts, accounts receivable, or asset accounts like inventory and PP&E increases the account. When you enter a credit into these accounts, it decreases the amount. In double-entry bookkeeping, each accounting entry affects at least two of the company’s accounts.

Is iShares MSCI USA Value Factor ETF (VLUE) a Strong ETF Right Now? – Nasdaq

Is iShares MSCI USA Value Factor ETF (VLUE) a Strong ETF Right Now?.

Posted: Wed, 28 Sep 2022 11:37:34 GMT [source]