Hello Guys, today we are going to discuss the topic “Artificial Intelligence in Finance Management and Law“.

Artificial intelligence is an essential component of modern finance. The progress artificial intelligence is achieving in finance is remarkable. It has made finance cheaper, faster, larger, more profitable, and efficient in many ways.

But every coin has two sides. Hence, there was significant progress in finance due to artificial intelligence, but it also presents serious risks and limitations. There are various limitations related to artificial intelligence in finance management. As we hear in the news, various scams and frauds are taking place in finance management, we need to be alert.

Artificial Intelligence, Finance Management and Law –

In 1992, Harshad Mahta scam took place which lead to unemployment and poverty in India. Hence, this fraud in the Indian stock market which made the entire securities system collapse. It was a fraud of over 1 billion from the banking system to buy stocks on the BSE, so it’s considered one of the biggest frauds in India.

There is an insightful perspective for thinking about the ever-increasing effects at the intersection of artificial intelligence in different sectors. Thereby about the finance, and the law with the hopes of creating better financial artificial intelligence. Better financial artificial intelligence basically implies that one that is less artificial, more intelligent, & ultimately more humane, and more human.

How AI Could Grow Jobs By Inventing New Ones-

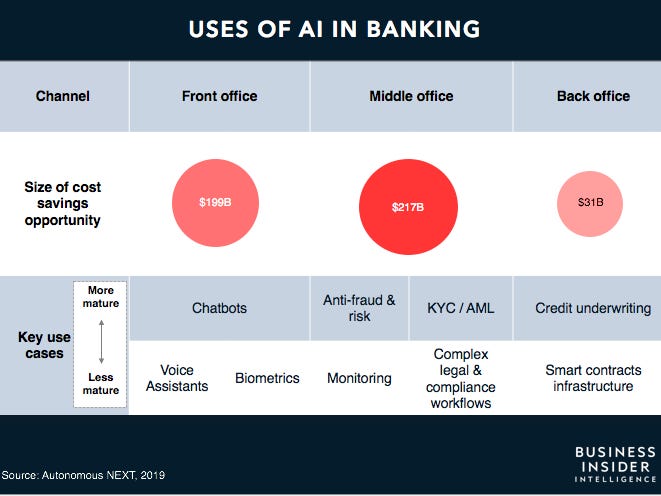

AI models use alternative data to determine whether to grant credit or to make pricing decisions. Artificial Intelligence uses consumer’s data points in order to identify his/ her choice of purchasing items. AI gives finance related advices to people in order to expand their profit margin. AI algorithms can also use alternative data at the credit servicing phase to determine what modifications to be done. It also offers a financially distressed consumer or when to engage in account management activities.